Introducing Seamless Payments for Creators & Brands with Banking Automation.

The problem:

1. Creator users only receive payments for their work through their debit card.

This limited the amounts of banks that creators could use because Stripe required banks to have use instant payout for debit cards.

2. Brand users are limited to paying out creators by only using a debit card.

This meant that card failure and delays in payments were more frequent since cards could be declined, expired, stolen, or frozen.

The solution:

Automated Clearing House (ACH)

An ACH payment is a type of electronic bank-to-bank payment. The ACH system is a way to transfer money between bank accounts, rather than going through card networks or using wire transfers, paper checks, or cash.

Creator ACH

Brand ACH

The hypothesis:

Enabling direct bank transfers broadens opportunities for creators, accommodating hundreds more banks with ACH payouts.

Debit cards are prone to being declined, theft, can be frozen, or expired. By allowing payments to be directly linked to the user’s bank account we are able to safely and securely payout creators for their collaborations.

ACH allows us to charge creators a flat $1.50 processing fee which is notably lower than the standard 4% transaction fee of total collaboration creator income. Potentially saving creators thousands of dollars in continuous processing fees over time.

This feature also benefits brands by reducing the number of failed payouts due to declines, fraud, expiration, and other errors commonly associated with debit cards.

While debit cards offer instant payout, they typically charge a standard fee that is 3% of the collaboration amount. In contrast, the introduction of ACH lowers the processing fee to a flat fee of $1.50.

Venmo

I reviewed Venmo as one of the competitors. This provided insights into their visual differentiation between the instant payment option, which incurs a fee, and the bank account option, which is free but has a slower turnaround time for funds to reach your bank account.

The research:

PayPal

In my analysis of PayPal, I focused on the user flow and paid attention to the common language used. It was noted that ACH is consistently referred to as "adding a bank account" to the users, therefore I wanted to design this with common practices in mind in order to not confuse the user with terminology they are not familiar with.

Lemon Squeezy

Finally, Lemon Squeezy's user interface was examined. Their page organization is similar to the current screens in the product. Because the aim for this addition is to require minimal effort on the front end, close attention was paid to the page layout for different payment methods on their platform.

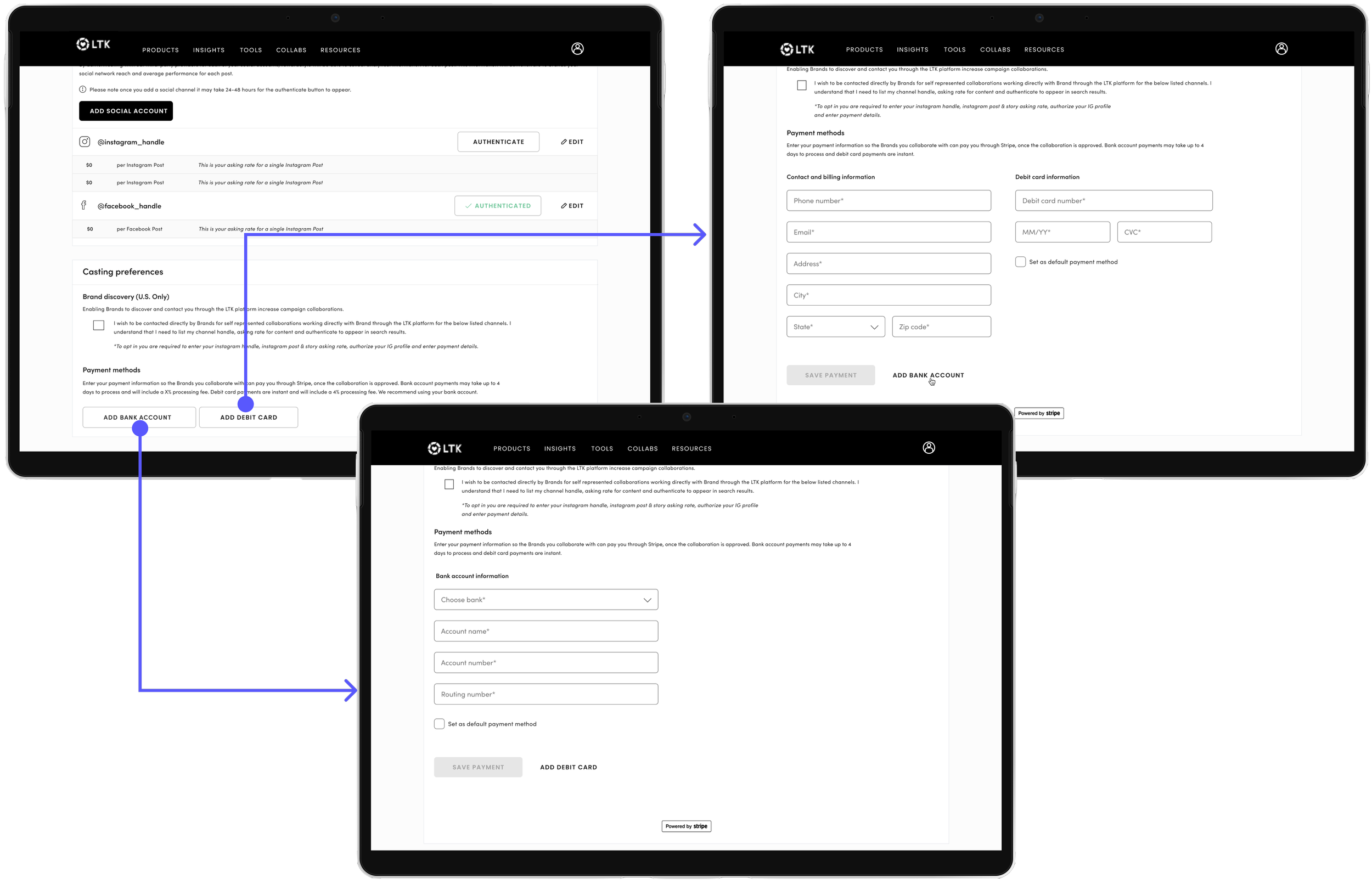

Creator idea 1:

Creator idea 2:

Add bank account through Stripe but keep debit card experience in LTK

Creator idea 3:

Add bank account and debit card within LTK

The ideation:

Throughout this project, collaboration with developers was crucial to ensure the feasibility of our solutions within the limitations of Stripe, our third-party payment service provider. The team's focus was on keeping the implementation effort minimal to quickly roll out this feature.

Add debit card and bank account through Stripe portal

Pros: Both experiences will be made within the same flow; my hypothesis was that this would be the easier development lift since we would use the Stripe component

Cons: May confuse users who are used to adding a debit card within the LTK portal; experience is only through Stripe which may lead to confusion as to why they are leaving the LTK portal

Pros: I assumed was that this would be a small development lift since we would keep the debit card experience the same and would remain a consistent experience for current users

Cons: May confuse users to add payment methods in ways; could lose users’ trust when lead to a Stripe window if they are unaware what it is used for

Pros: The debit card input would be consistent for current users and the addition to inputting a bank account would match the current flow within the LTK portal

Cons: This seemed like the biggest lift since all of the development would be within the LTK UI, unsure if this is possible for developers to execute

Brand idea:

Add bank account and debit card within Stripe

Pros: Because the users already enter their debit card through a Stripe page, entering bank details through the same page will be more familiar to the brand and also be the lowest development lift

Cons: The experience is not through LTK

The designs:

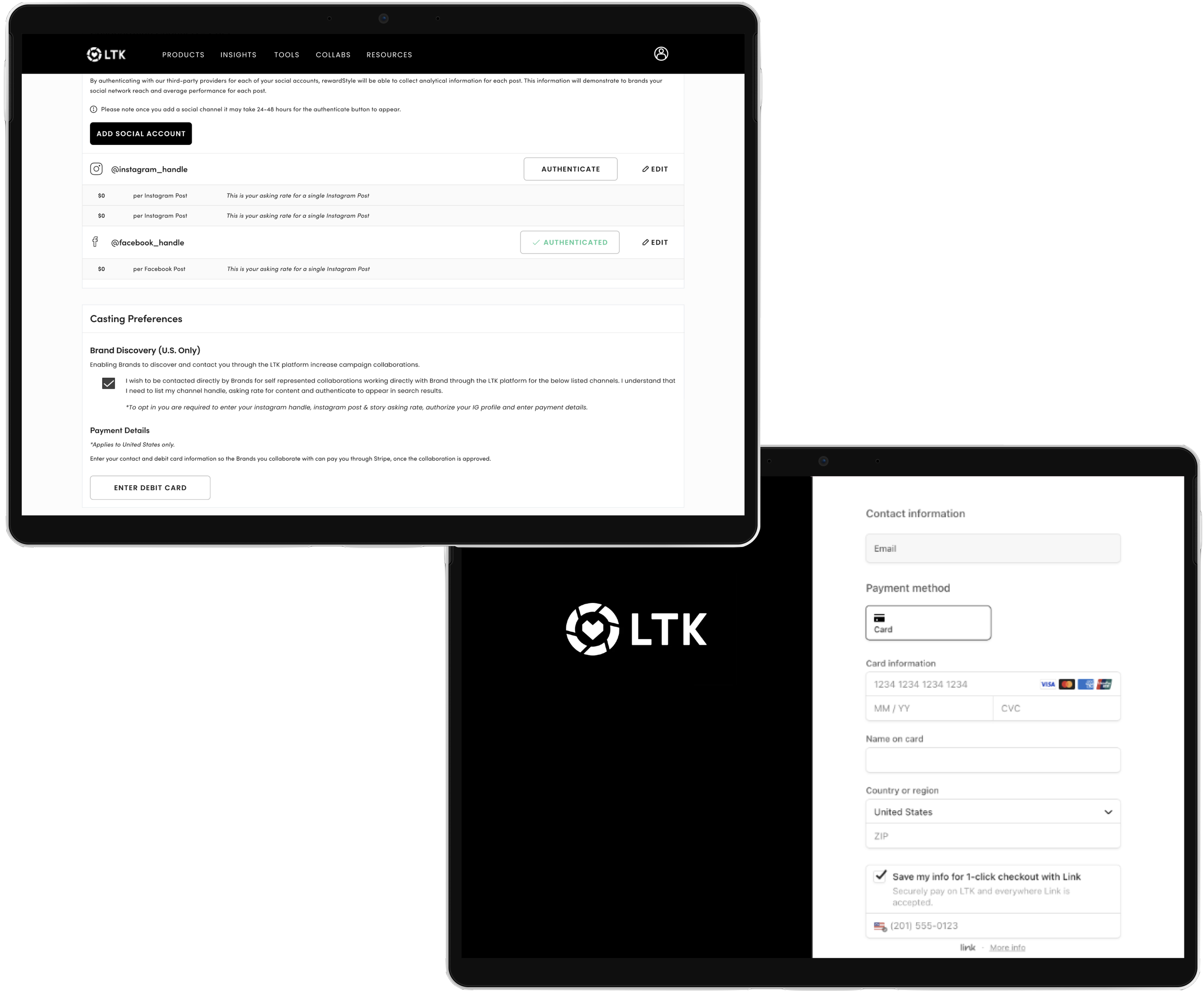

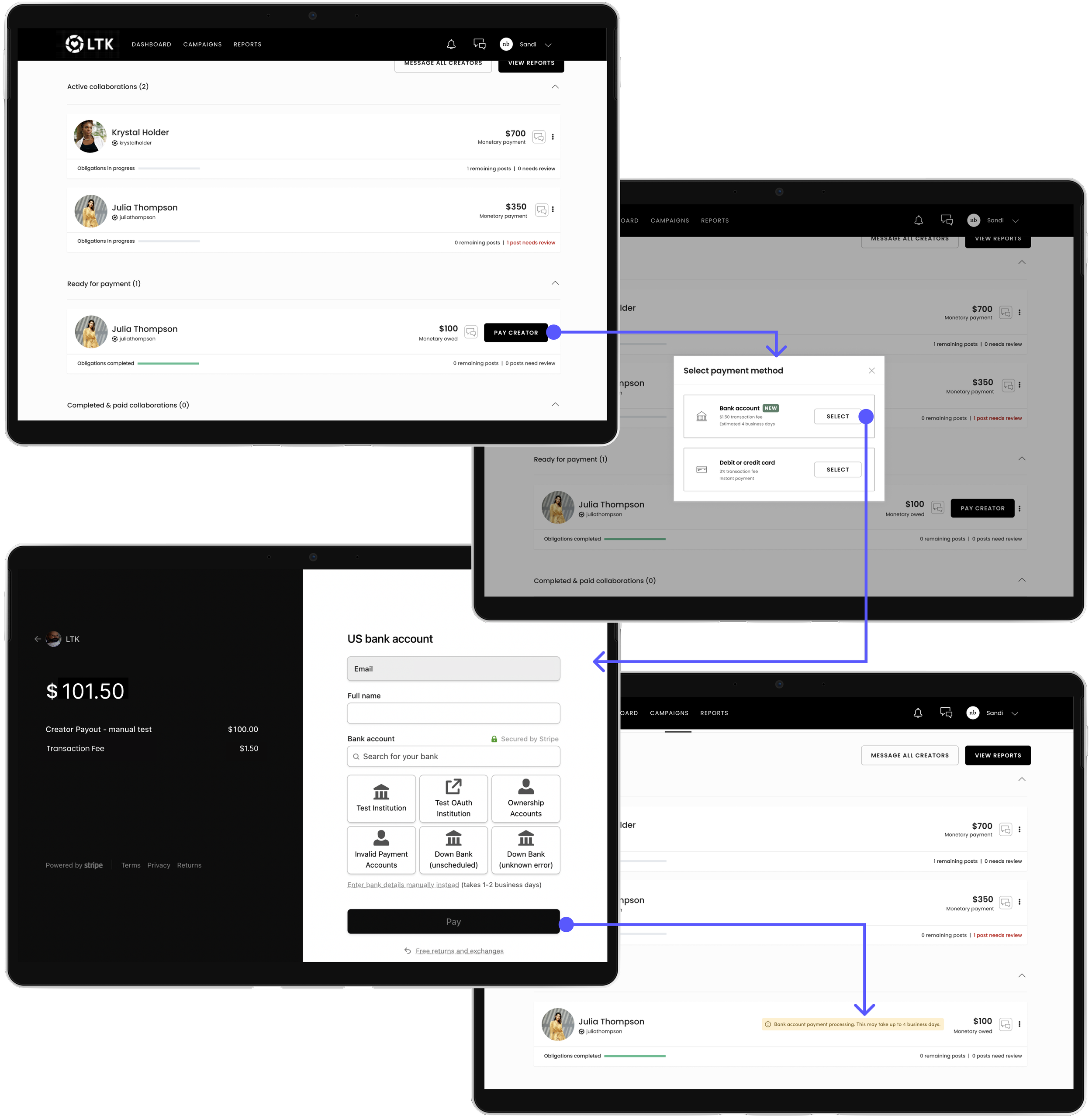

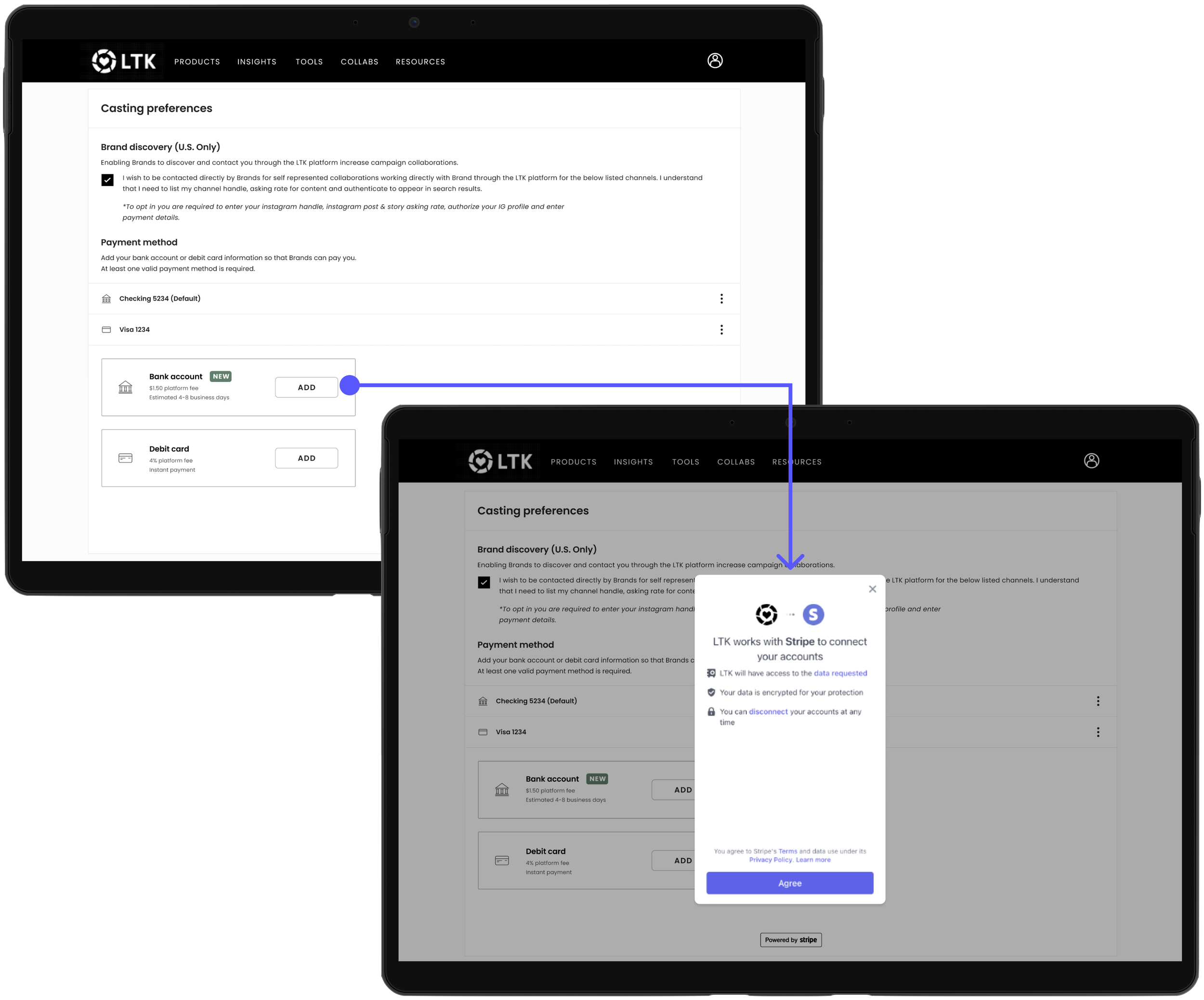

I presented these ideas to the development team to gauge the complexity of each solution and determine their feasibility, as we were in the early stages of the design process. It was concluded that creator idea 1 was not feasible. Creator option 3 was deemed too complex. Therefore, we opted for creator option 2, but with a modification. Instead of directing the user to a Stripe window to enter the details, which was not feasible, we decided to allow the user to use a Stripe modal to fill out the bank account details. The design team was in support of this approach because it has the added benefit of keeping the user within the LTK window while entering the bank account details.

Creator flow: Adding payment method

Before

After

A card is set to default so the creator can now get start right away on collaborations.

Education is added to inform the creator on the platform fee amount and resources to articles that can give more information helpful to them.

New CTA to “add new payment method” directs the creator to profile page to complete this action.

The call-to-action (CTA) was previously “enter debit card.”

Triggered a form field with inputs that are required when adding a debit card.

No information that informs the user on the processing fee.

Before

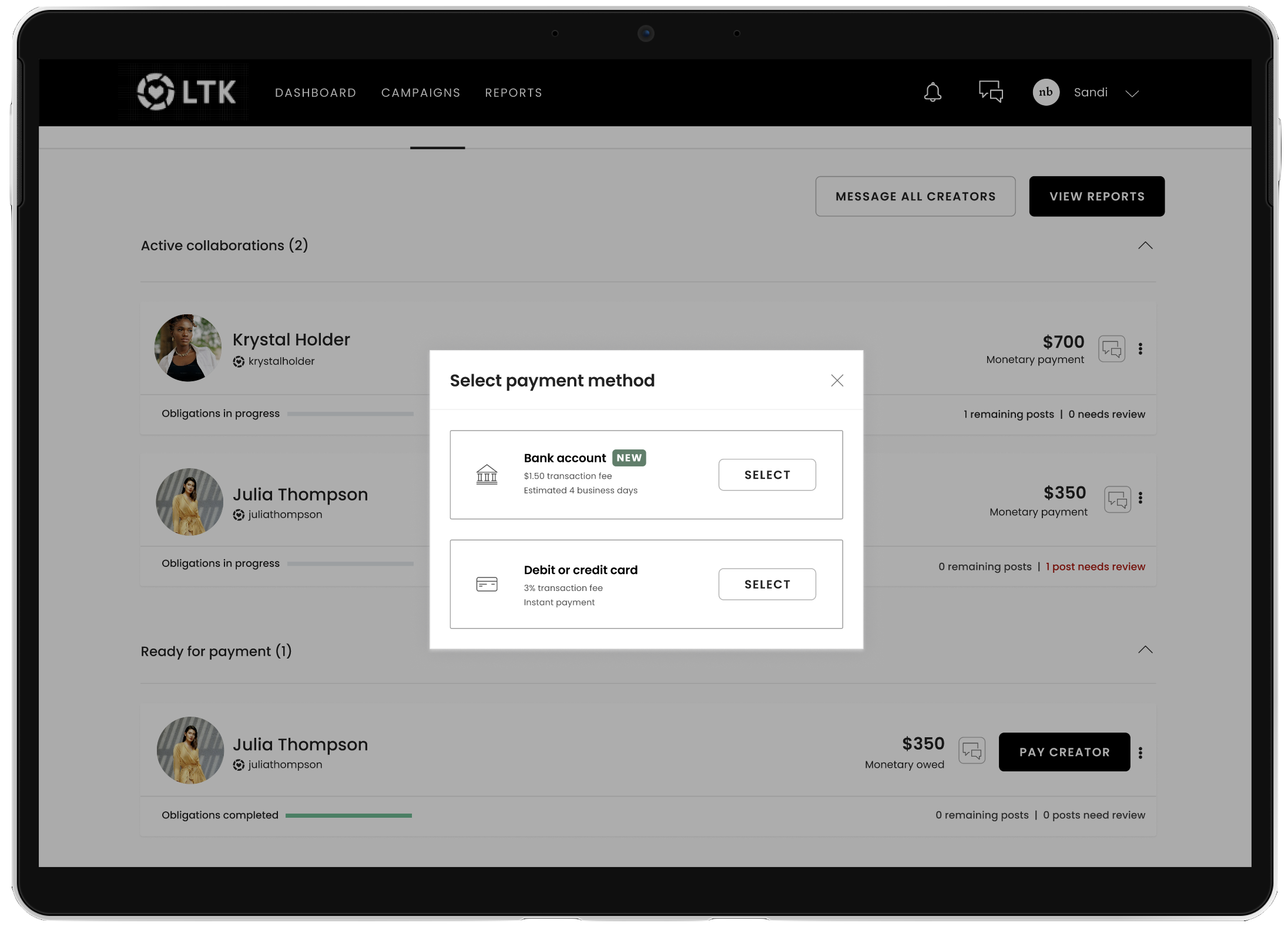

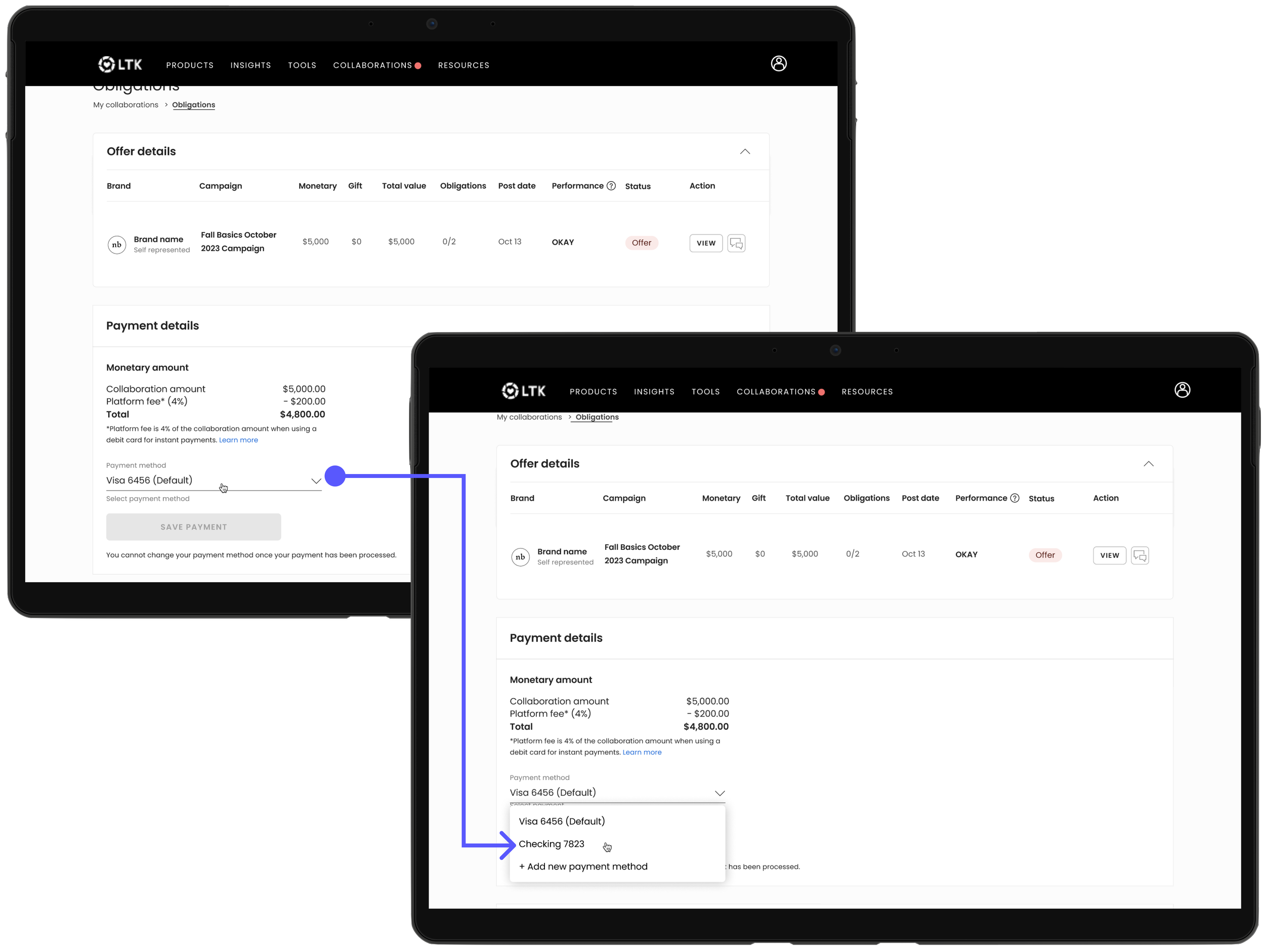

Brand flow: Selecting payment type

Brands could only add in their debit card details through a Stripe checkout.

No clear information on the transaction fees and the status of payments.

Before

New modal that displays the different timeframe and fees between the two payment methods.

Ability to checkout with bank account information.

Insight into the status of the payment method.

After

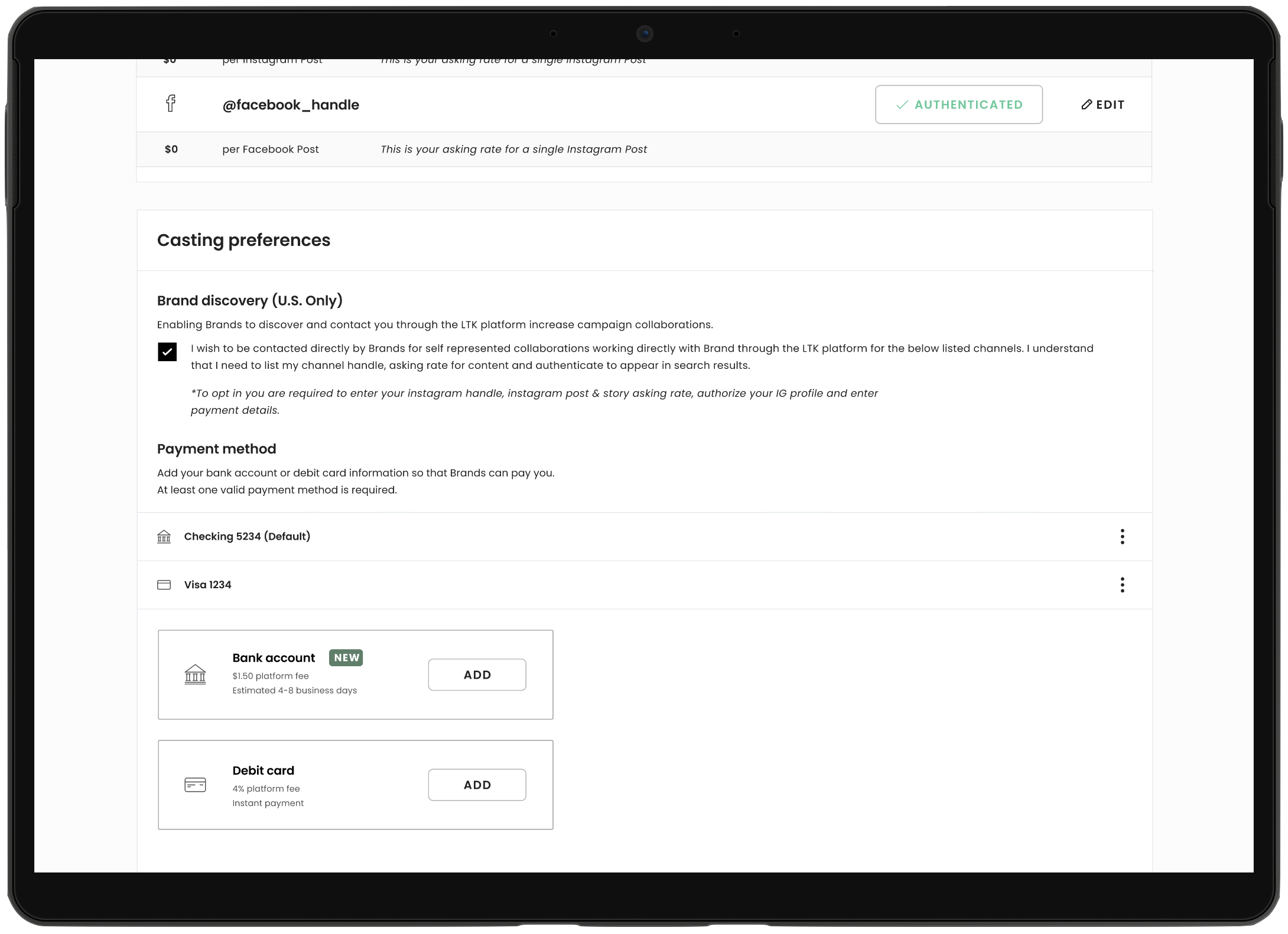

New boxes to separate adding a bank account and debit card with descriptions on the difference between them.

Removal of card “nickname” and replacing it with card/bank type and last four digits of card/bank number.

Modal to add the bank account information instantly through Stripe.

For the brand side, we aimed to keep the effort minimal and maintain consistency with the current user flow. After discussions with developers, the only limitation we encountered was the need to trigger a modal for the user to select between paying out through a debit card or bank account before directing them to the Stripe page.

After

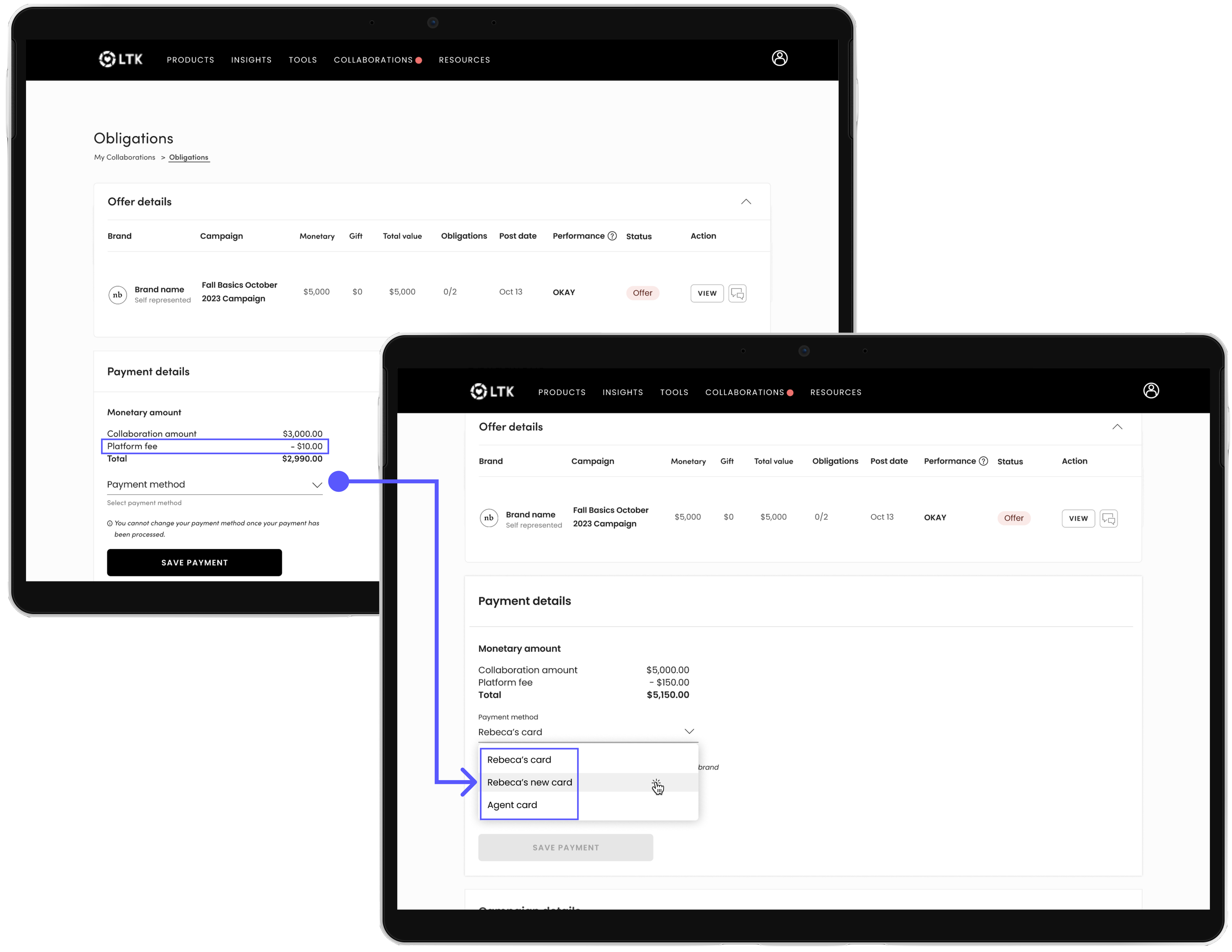

Creator flow: Selecting payment type

Payment method must be selected before starting the collaboration each time.

No CTA to add a new payment method.

Limited information on how the platform fee is calculated.

Card “nicknames” can be misleading since there is no education on best naming practices.

The final delivery:

Creator flow: Adding payment method

Creator flow: Selecting payment type

Brand flow: Selecting payment type

The final impact:

ACH for creators reduced creator fees from $88k to $6k in the first year of implementation.

There was a 53% adoption rate while increasing the creator payments by $12k and 0 failed payments.

This project enables users to receive payments for collaborative work, expanding support to approximately 500 additional banks for payment processing.

We significantly scale down the manual process that developers had to plan into their sprints to go in and fix failed payments.

1. Scale internationally

The future:

2. Mobile friendly

We designed with the desktop web view at the forefront. I would love to go in and create a full mobile flow for both the creator and brand side. We are limiting our users by only having larger screens accessible. Creators also exclusively use thier phones when creating and uploading this content so it would help their work flow to have everything available at their fingertips.

3. Transaction history

A place for creators to be able to go to see their collaboration payment history is needed. There is no area in the product today for the creator to see a rollup of transaction history which would be helpful to compare against thier banking statement and would make it easier to keep track of their income.

We need to think on an international scale and be able to accommodate international creators which we cannot support currently because of Stripe limitations. This would give up access to thousands more creators and increase the diversity of them, which has been feedback we have been receiving from brands.